Technology giant Huawei has partnered with Chinese chipmaker Semiconductor Manufacturing International Corp. (SMIC) to develop a cutting-edge 7 nanometre (nm) semiconductor chip used in the processor of Huawei’s latest smartphone — Mate60 Pro. The microchip, known as Kirin 9000s, is the first 7 nm chip manufactured entirely by a Chinese company.

The chip’s development signals a significant advancement for China in semiconductors.

The 7-Nanometre Microchip

In semiconductor technology, the term nanometre (nm) refers to the size of individual components within the chip, like transistors and wires. One nm is equal to one billionth of a metre. To put this in perspective, a human hair strand is approximately 80,000 nm wide; therefore, one nm is equal to 1/80,000th the width of a human hair.

A key indicator in assessing the superiority of a chip is the ability of the device to accommodate a higher number of transistors. This enables the chip to power advanced devices with little or no space constraint and produce greater computational power and faster processing speeds.

Hence, developing a 7 nm chip is a significant milestone for China, allowing the country to create more devices for multiple uses (military included) with advanced computing power.

Why This Could be a Game-Changer for China

China’s development of a 7 nm microchip is significant for several reasons, even though such chips have been manufactured previously by other companies.

Technological independence

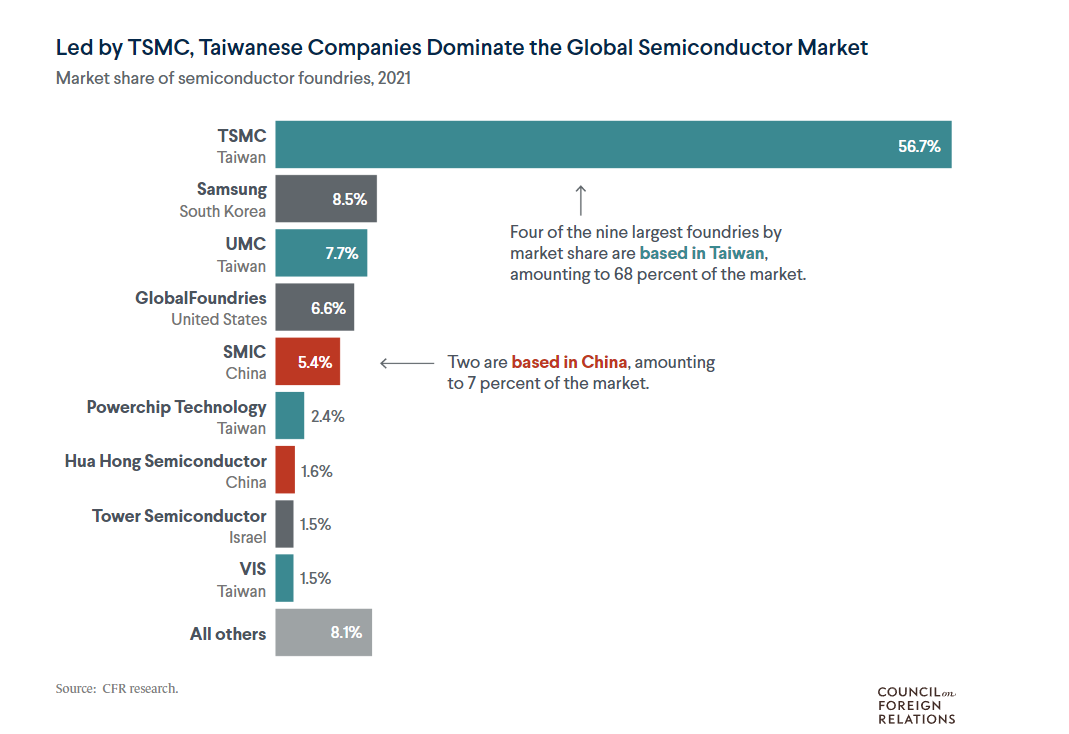

The fact that SMIC, a partially state-owned foundry, is producing advanced 7 nm chips implies that Beijing’s efforts to build a domestic chip ecosystem are paying off. The development suggests that China is putting in serious efforts to end its reliance on foreign chip manufacturers like Taiwan Semiconductor Manufacturing Company (TSMC).

According to estimates, over 30% of China’s chip imports come from Taiwan and over 90% of semiconductors used in China are imported or manufactured locally by foreign suppliers. The reliance on Taiwan is further cemented when it comes to advanced chips, for which the disputed island accounts for at least 90% of global production.

However, the latest breakthrough could propel Beijing towards greater self-sufficiency in manufacturing advanced microchips locally.

Countering US sanctions

The development indicates that China is willing to do whatever it takes to reduce the impact of US sanctions on Chinese tech companies like Huawei.

Earlier this year, Washington halted giving licences to American firms to export technology to Huawei, intensifying the US crackdown on Huawei. The US believes that Huawei is working with the Chinese Communist Party. Washington has accused Huawei of spying on American military installations and labelled the company as a national security threat.

The US has also blacklisted Huawei and SMIC to set them almost eight years behind the most advanced semiconductor technology in the hopes that Chinese companies would not immediately manufacture chips below 14nm.

However, according to Bloomberg, with the latest breakthrough, China has advanced to being just five years behind the latest technology. In fact, Chinese media are already calling the development a victory for Beijing and a failure of US efforts aimed at curtailing Chinese technological advancement.

Reducing the impact of a potential war with Taiwan

Following Russia’s invasion of Ukraine last year, analysts have warned that a similar Chinese move against Taiwan is not far-fetched. However, a war with Taiwan could destroy its semiconductor foundries, effectively ending the flow of advanced semiconductors to China and hurting its tech industry, severely denting the Chinese economy.

Although it is not clear whether China could mass produce 7 nm chips in the short term, SMIC’s achievement is definitely a step in the right direction.

Challenges

Despite this major breakthrough, the Chinese path towards complete self-sufficiency in manufacturing advanced microchips is riddled with roadblocks.

1. There is no indication that China can produce these chips at a scale that meets market demand or sell them at a reasonable cost, crucial for competitiveness in the global semiconductor industry. According to reports, the Mate60 Pro sold out almost immediately, a possible indication that the chip is available only in limited quantities.

2. There is speculation that Huawei stockpiled chips from Taiwan’s TSMC before the US slapped sanctions on it. The argument here is that China is sitting on a limited store of 7 nm chips, and once this stockpile runs dry, China’s efforts could be hampered.

3. Moreover, 7 nm chips require American technology to be made. Even TSMC relies on US machinery, software, and materials to produce advanced chips. This indicates that manufacturing smaller chips could be difficult for Beijing as it is on a US sanctions list and hence, cannot access US technology. The only way China can bypass this is if it has the ability to manufacture semiconductor components as well. So far, it is unclear whether China has this capability.

4. While China has demonstrated that it can manufacture advanced 7 nm microchips domestically, the technology is, as per estimates, almost two generations behind the latest development in the field. For instance, Apple’s available iPhone models run on 4 nm chips and the US company plans to introduce 3 nm iPhones to the market soon.

5. Additionally, chips smaller than 7 nm are manufactured using advanced technologies, from which China is cut off. For instance, TSMC uses Extreme Ultraviolet Lithography (EUV) machines to make the 4 nm chips it supplies to Apple. These machines are currently manufactured by ASML Holding, a Dutch company, and China is barred from importing advanced technologies from ASML.

Major Takeaways

- The development is a major technological advancement for China.

- It remains unclear how China managed to manufacture 7 nm chips. Was it from exhaustible chip stockpiles imported from Taiwan before sanctions were imposed? Or has China created its own semiconductor manufacturing ecosystem, where it has ended reliance on foreign companies?

- The answers to these questions would give a clear picture of where China stands in the semiconductor race. However, more clarity is required on these questions for now.