Weeks after refusing to support any new bill that could increase inflation in the country, United States (US) Senator Joe Manchin (D-WV) declared on Wednesday that he had agreed to endorse a landmark legislation worth $739 billion that reduces the trade deficit, lowers healthcare costs, taxes the wealthy, and invests billions in energy and climate change programmes.

“Rather than risking more inflation with trillions in new spending, this bill will cut the inflation taxes Americans are paying, lower the cost of health insurance and prescription drugs, and ensure our country invests in the energy security and climate change solutions we need to remain a global superpower through innovation rather than elimination,” Manchin said in a statement.

From here forward, the debate over a future reconciliation bill or any targeted legislation must focus on supporting the everyday hardworking Americans we have been elected to serve. I support the Inflation Reduction Act of 2022 because it provides a responsible path forward. pic.twitter.com/ERWjEMPoJI

— Senator Joe Manchin (@Sen_JoeManchin) July 27, 2022

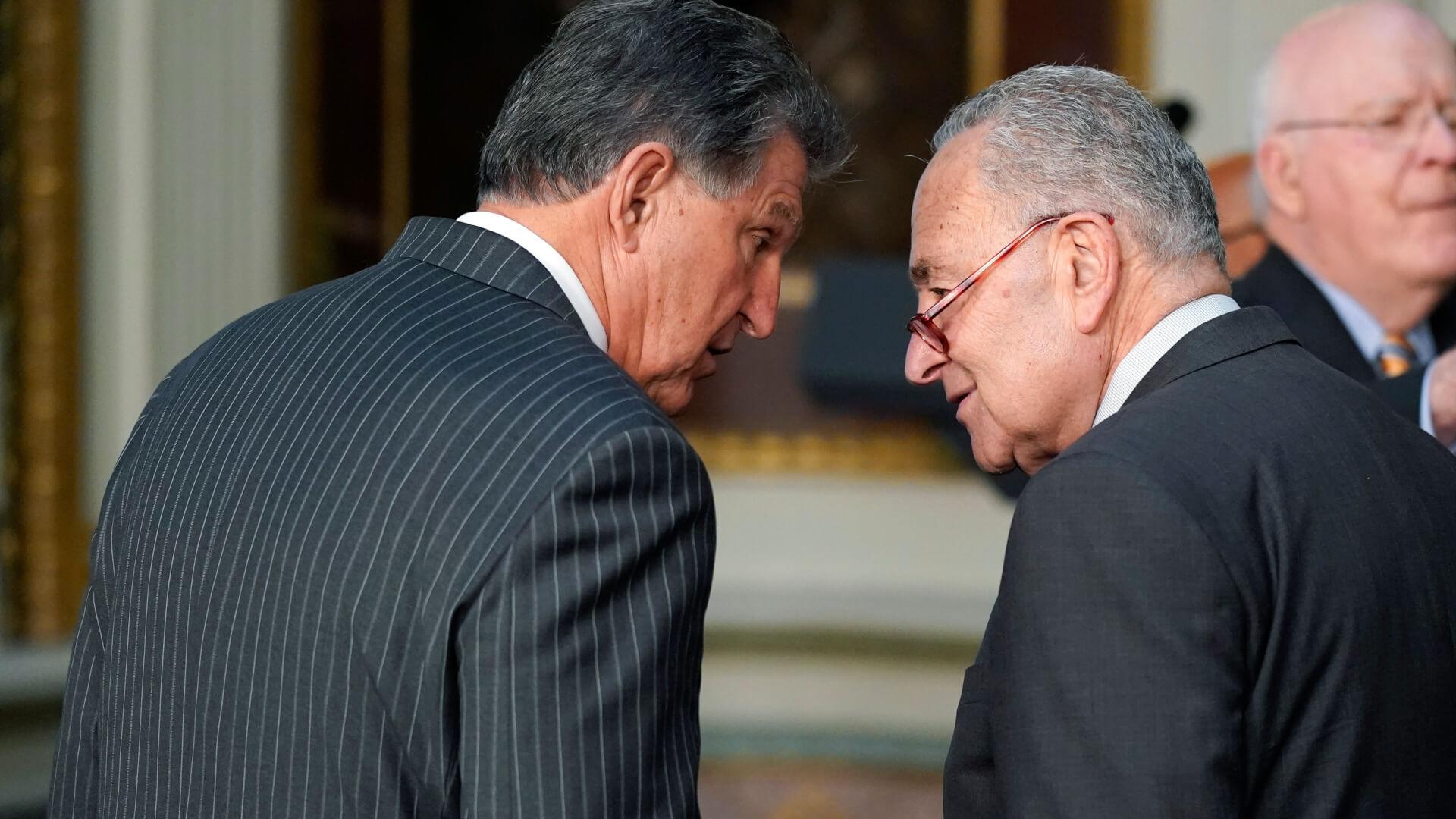

To this end, Senate Majority leader Chuck Schumer (D-NY) and Manchin announced a “historic” bill titled Inflation Reduction Act of 2022, which aims to reduce carbon emissions by almost 40% by 2030 and has been touted as the “greatest pro-climate legislation that has ever been passed by Congress.”

According to a brief summary of the legislation, about $369 billion would be set aside for energy security initiatives and to combat the climate crisis. In this respect, Manchin mentioned that Biden, Schumer, and House Speaker Nancy Pelosi had promised to promote “permitting reforms this fall that will ensure all energy infrastructure, from transmission to pipelines and export facilities, can be efficiently and responsibly built to deliver energy safely around the country and to our allies.”

Our legislation will be the greatest pro-climate legislation that has ever been passed by Congress

— Chuck Schumer (@SenSchumer) July 28, 2022

It fights the climate crisis with the urgency the situation demands and puts the U.S. on a path to roughly 40% emissions reductions by 2030, all while creating new good-paying jobs

The bill plans to tax the “ultra-wealthy” and billion-dollar corporates with a 15% corporate minimum tax, which would raise $313 billion over the next decade. It would allow the Internal Revenue Service (IRS) to enforce taxes stringently, which according to Congressional Budget Office estimates would bring in an additional $124 billion in tax revenue. However, it wouldn’t impose any new taxes on families with a yearly income of less than $400,000 nor on small business, in line with US President Joe Biden’s campaign promises.

Furthermore, state-owned Medicare would be able to negotiate the prices of prescription drugs for the first time and put a price cap on out-of-pocket costs to seniors and the disabled at $2,000. The coverage of the Affordable Care Act would also be increased for existing customers for another three years by adding $64 billion. Additionally, new electric vehicle owners belonging to middle-income families would get a $7,500 tax benefit while used EVs would get a $4,000 rebate.

The bill is expected to be passed in the Senate next week with a simple majority through a manoeuvre called reconciliation bill, which doesn’t allow for any filibuster.

Very pleased that Schumer and Manchin have reached a deal to combat inflation, climate change and our deficits.

— Adam Schiff (@RepAdamSchiff) July 28, 2022

This agreement will lower drug costs, and make a major investment in saving the planet.

There is still a lot of hard work ahead of us. But this is exciting news.

Though the bill has been significantly reduced from the Democrats’ ambitious $2 trillion Build Back Better Act that the party struggled to pass in both houses, Biden expressed his support for the legislation by saying, “This is the action the American people have been waiting for.” He urged the Senate and House to pass the draft law at the earliest.

Along the same lines, Pelosi welcomed the “remarkable achievement,” noting, “We will continue to fight for priorities not contained in this legislation — because more must be done on behalf of America’s working families and to save the planet.”

Democrats have already crushed American families with historic inflation.

— Leader McConnell (@LeaderMcConnell) July 27, 2022

Now they want to pile on giant tax hikes that will hammer workers and kill many thousands of American jobs.

First they killed your family's budget. Now they want to kill your job too.

Manchin had earlier opposed the proposed legislation, saying he would only agree to any new tax bill after checking with the inflation figures for July and the stated projections for the rest of the year. However, he did not touch upon what changed his mind, seeing the inflation figures will be released only after two weeks. According to sources, he came on board with the climate and energy components after being assured that $300 billion of the country’s $30 trillion national debt would be paid up to fight inflation.

The legislation coincides with the Senate passing a bill to make semiconductors in the country at subsidised rates to counter China. However, Senate minority leader Mitch McConnell (R-Ky) had stated that he would not support the bill if the Democrats went along with the expansive domestic policy bill. Nevertheless, the Republicans noted that since the semiconductor legislation is yet to be passed in the House, they would instruct their representatives to oppose it.

Today's deal with Manchin appears at this moment to be a masterstroke for Schumer who deprived McConnell of leverage by passing CHIPS first

— Erik Wasson (@elwasson) July 27, 2022

Meanwhile, Republicans have been unanimously opposing the proposed climate and tax bill, with Senator Lindsey Graham, (R-SC) saying that the bill makes “no sense” and expressed surprise that Senator Manchin was “agreeing to a massive tax increase in the name of climate change when our economy is in a recession.”

Similarly, Senator John Cornyn’s (R-Texas) office said Manchin had “flip-flopped” on passing a major tax reform bill. “Senate Democrats can change the name of Build Back Broke as many times as they want, it won’t be any less devastating to American families and small businesses,” Cornyn noted, referring to Biden’s Build Back Better Act.