Saudi Arabia is considering the prospect of pricing oil sales to China in Yuan instead of the United States Dollar (USD), the Wall Street Journal (WSJ) reported on Friday. Experts note that such a move could potentially hurt the USD’s dominance in the global oil market as well as its standing as the global reserve currency.

While Riyadh has been negotiating with China regarding the switch to Yuan for over six years, such a move looks increasingly possible now, as the Saudis have recently expressed displeasure over the US’ dwindling security commitment to defend the Kingdom. Officials familiar with the matter told WSJ that Saudi Arabia is engaged in “active talks” with China to make the switch.

As per the WSJ, Riyadh is also weighing the option of including Yuan-dominated futures contracts (Petroyuan) in the pricing model of the Kingdom’s Oil Company—Aramco. This could potentially dent the US’ ability to impose harsh sanctions on China, as Saudi Arabia would not be violating US restrictions if it trades in Yuan.

Breaking: Saudi Arabia is considering settling oil sales to China not in US Dollars but in Chinese Yuan.

— Richard Medhurst (@richimedhurst) March 15, 2022

The decline of US hegemony is in full swing. This is exactly what we meant by the West "shooting itself in the foot". This is just the beginning.

Washington and Riyadh agreed in 1974 to price oil sales in USD in exchange for US security guarantees. The US has followed through on its promise by providing Saudi Arabia with defence equipment worth billions of dollars and even fighting a war against Iraq in 1990 on behalf of the Kingdom.

However, more recently, US-Saudi ties have taken a hit after Washington raised concerns about human rights abuses in the Kingdom and blamed Crown Prince Mohammed bin Salman (MBS) for the murder of journalist Jamal Khashoggi. The US also removed its Patriot missile defence system from Saudi Arabia in September 2021. Experts have noted that the move was seen by Riyadh as Washington abandoning a strategic ally, especially at a time when Yemen’s Houthi rebels have increased missile and drone attacks on Saudi facilities.

Saudi officials also raised concerns regarding the US’ hasty withdrawal from Afghanistan in August last year, which resulted in the Taliban returning to power and the further destabilisation of the war-torn country. Riyadh is also opposed to the Biden administration’s push to revive the 2015 Iran nuclear deal, a move the Saudis believe could enable Iran to produce a nuclear weapon. Additionally, Saudi Arabia fears that reviving the deal would provide Tehran with sanctions relief and allow it to release greater funds to the Houthis, with whom Saudi Arabia has been waging a seven-year-long war.

Moreover, a US intelligence report released by the Biden administration last year accused MBS of approving Khashoggi’s assassination. The document said that MBS had “absolute control” of the Saudi security apparatus, which made it unlikely that Saudi officials carried out the killing without his authorisation. Riyadh, however, has fiercely denied claims that the Crown Prince was involved.

MBS has consistently denied his involvement in Khashoggi’s murder and recently said that he does not care about whether the US thinks he is responsible. He warned US President Joe Biden that alienating the Saudi monarchy would only harm US interests.

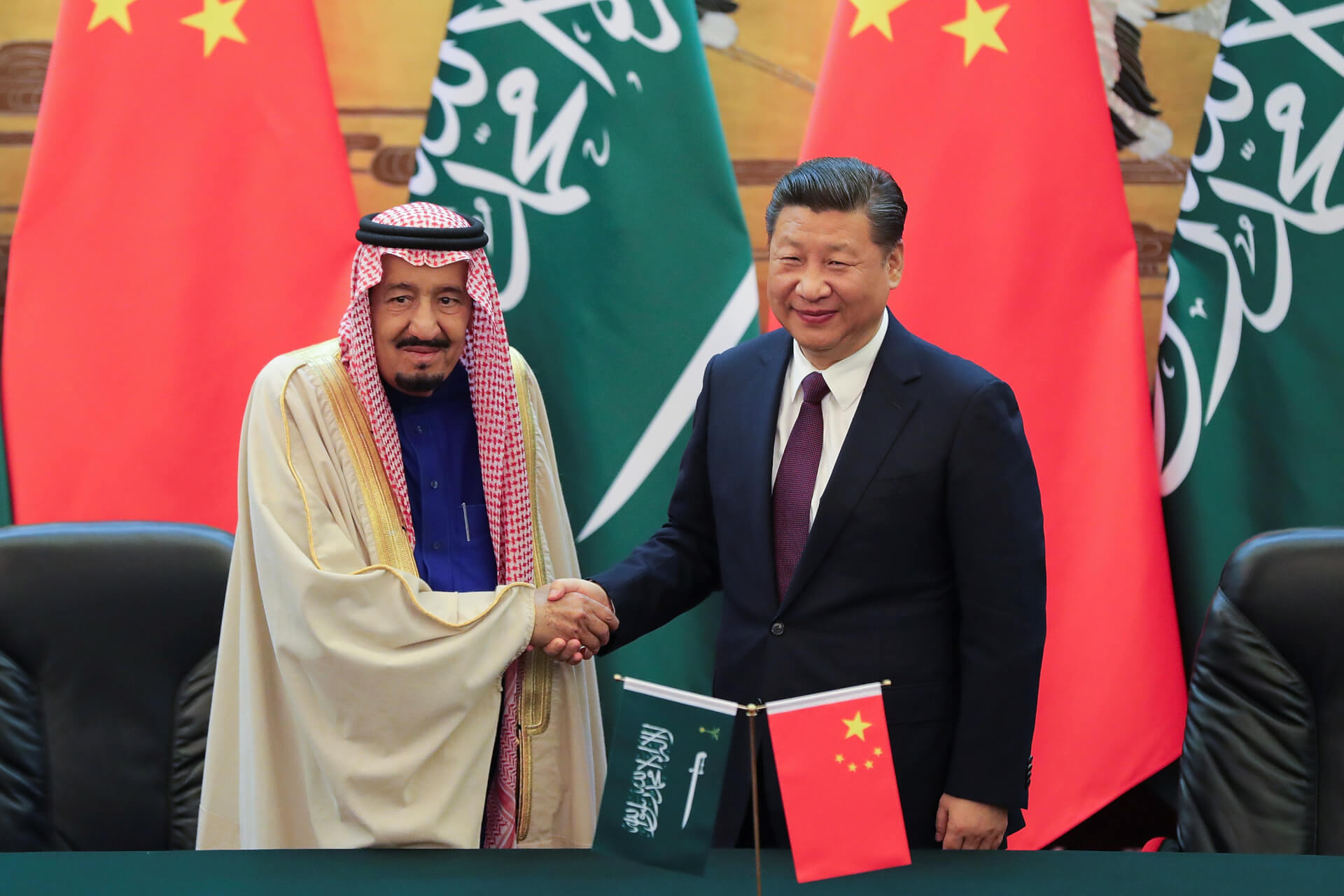

Against this backdrop, Riyadh has sought greater ties with Beijing, which has been seeking a larger footprint in the Middle East for a long time. In December, US intelligence agencies reported that Saudi Arabia is manufacturing ballistic missiles with the help of China. Per reports, Riyadh had “sought help” from the People’s Liberation Army Rocket Force, the Chinese military’s missile branch, to assist with the production.

Saudi Arabia is the biggest supplier of crude oil to China, which imports around 16% of its crude oil from the Kingdom. Furthermore, China imports 25% of Saudi Arabia’s total oil exports. Chinese oil companies have also signed several agreements with Aramco for supplying new refineries and petrochemical plants in China.

In a parallel development, Russia has reportedly offered India heavily discounted rates for oil and other commodities, and suggested switching to a “rupee-ruble-based” trade, wherein Indian exporters can pay in rupees instead of dollars or euros. This would be achieved through a “floating exchange rate system” through a third currency, perhaps the yuan, as a point of reference.