Despite a barrage of Western sanctions over Ukraine’s invasion, the ruble lept to a near seven-year high at 58.75 against the euro, strengthening by 6.3% on Monday. Likewise, the Russian currency gained 4.6% against the dollar at 57.47, the strongest it has been since March 2018.

Overall, the ruble has strengthened by 30% against the dollar this year, making it the world’s best-performing currency.

Ruble is higher now than before Russian invasion of Ukraine. Biden drove up price of oil and hasn’t sufficiently sanctioned Russian oil exports. So Russia has more money than ever to finance its war. Great job. pic.twitter.com/hCqQI6AU5X

— David M Friedman (@DavidM_Friedman) May 23, 2022

Russia’s economy ministry on Monday remarked that the ruble’s appreciation is attaining “a peak” and that “capital flows and imports will adapt.”

The steep rise in the ruble could be accounted to the supply of foreign currency from exporters, rising oil prices, an upcoming month-end tax period that prompts export-focused companies to convert their foreign currency revenues into rubles to meet local liabilities, and a host of capital controls imposed in the aftermath of the Russian invasion of Ukraine.

The Kremlin has mandated Russian exporters to convert 80% of their hard currency revenue into rubles. However, according to Bloomberg, Moscow may ease that to 50% this week.

Despite Biden Admin’s repeated hype about US sanctions:

— Marshall S. Billingslea (@M_S_Billingslea) May 17, 2022

• Russia has tripled its current account surplus to $95.8 billion from Jan-Apr ‘22

• Russian oil export revenue up 50% in ‘22

• Ruble is up 11% vs US dollar in ‘22

We need real sanctions, now.https://t.co/NY9YrShZqE

Russia has also eased limits on foreign exchange operations it imposed at the onset of the war. The central bank is now allowing Russians and non-residents to send up to $50,000 in foreign currency abroad compared to the $10,000 limit that was in place earlier.

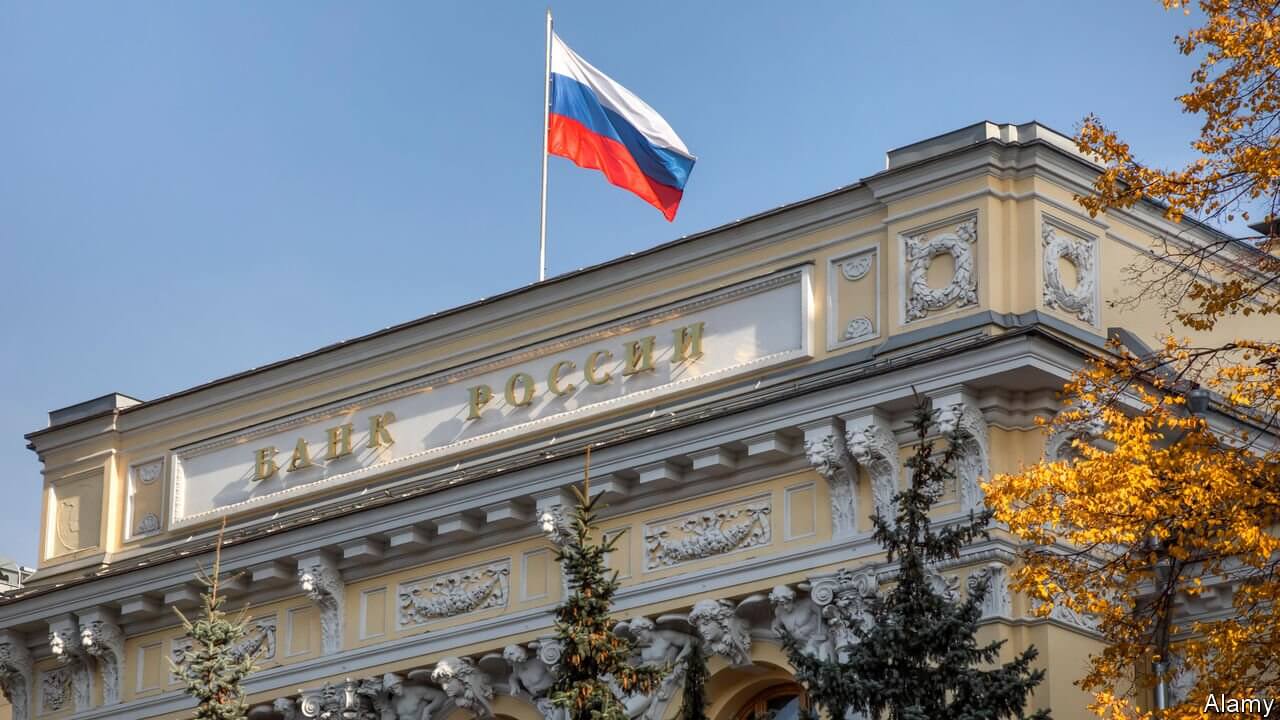

The ruble’s appreciation has made Russian exports more expensive and less competitive abroad. In this regard, on Monday, The Vedomosti Daily reported that the Russian central bank is purchasing foreign currency to stop the ruble’s uncontrollable strengthening, a report denied by the Bank.

Analysts with Tinkoff Investments noted that if the Russian central bank and government keep the current restrictions in place, the ruble could continue to strengthen in the medium term. “Closer to autumn, the exchange rate may start to stabilise nearer to the 60-65 level as imports recover and restrictions are potentially lifted,” said the analysts.

Likewise, Otkritie Bank analysts predicted that the ruble could come down to 55 against the dollar by the end of this month before depreciating to 70-80 by the end of 2022. Analysts further said Russian President Vladimir Putin’s demand for gas payments in rubles has played a huge role in this appreciation.

The ruble is not convertible, the exchange rate is based on a very low turnover where the Russian national bank have almost all influence. It's basically a fake rate. https://t.co/rNoa13nTMN

— Anders Östlund (@andersostlund) May 20, 2022

In fact, Italian and German gas companies recently agreed to Putin’s demand to pay for natural gas in the rubles. Earlier, The European Commission (EC) released updated guidelines on how the European energy companies could pay for Russian gas in rubles without breaching the European Union’s (EU) sanctions against Russia, even though members continue to deliberate on an oil embargo.

The Commission noted that the bloc’s sanctions do not restrict companies from opening an account in Gazprombank to pay for gas imports, so long they pay in the currency mentioned in existing contracts—euros or dollars—and the conversion is left up to the Russian bank authorities.

The Commission’s guidelines come after Putin back in March asked “unfriendly countries,” including the United States and the European Union, to pay for gas deliveries in rubles and threatened to cut supplies if they failed to comply.

Putin asked importing nations to open a bank account with Gazprombank, a subsidiary of Russian energy giant Gazprom, to facilitate ruble payments. The vast majority of European countries opposed Putin’s demands, calling it a violation of existing contracts, which mandate payments in the euro or dollar for gas imports.

Making true on its threat, Russia cut gas supplies to Poland and Bulgaria last month over their refusal to pay in rubles. On Saturday, Russia also cut electricity supplies to Finland.

The Kremlin can’t artificially prop the ruble up forever.

— Angry Staffer 🌻 (@Angry_Staffer) May 22, 2022

On top of that, we are seeing evidence that the sanctions and export controls are having a significant impact on their manufacturing industry. This isn’t sustainable for Russia. https://t.co/kjpYEp5hHX

Some analysts have called Moscow’s measures to stop the ruble’s depreciation a “manipulation,” whereby it has created artificial demand for the ruble. Charles-Henry Monchau, a chief investment officer at Syz Bank, noted that very few people outside Russia want to buy rubles “unless they have to” and traders “no longer see the ruble as a free trade currency.”

Monchau noted, however, that if Russia attains a solution to the Ukraine problem by restoring ties with the West and withdrawing sanctions, the ruble can retain its value. On the other hand, if Russia withdraws without a resolution, the currency could collapse, leading to a rise in domestic inflation and a deep economic recession.