US-based ratings agency Fitch downgraded Pakistan’s long-term foreign currency Issuer Default Rating (IDR) on Tuesday, warning that Islamabad defaulting on its foreign debt, or requiring debt restructuring, is “an increasingly real possibility.”

It lowered Pakistan’s rating, which stands on a scale of A to D, from CCC+ to CCC-. This comes shortly after it dropped Pakistan’s rating from B- to CCC+ in October.

Worsening Economic Situation

Highlighting the economic stresses on Islamabad, the report highlighted that the downgrade resulted from a “sharp deterioration” in Pakistan’s “external liquidity and funding conditions.”

🚨 Pakistan's rating downgraded for the second time in months by Fitch

— Faseeh Mangi (@FaseehMangi) February 14, 2023

It's been cut by two notches straight, not by the usual one pic.twitter.com/afZQy74GIV

The report noted that Pakistan would have over $7 billion worth of external public debt maturing by June 2023, of which $3 billion worth of deposits from China are likely to be extended. Further, $1.7 billion worth of loans from Chinese banks will be refinanced shortly.

Nevertheless, Fitch acknowledged that the Pakistani government has provided reassurances of its intention to “remain current on all debt obligations.”

Plummeting Forex Reserves

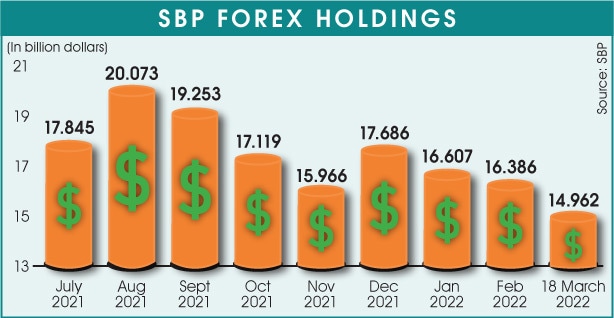

Fitch remarked that the country’s foreign exchange reserves had dropped to “critically low levels.” The State Bank of Pakistan’s liquid reserves had plummeted to $2.9 billion as of 3 February 2023, which is enough for merely three weeks of imports. The reserves had stood at $20 billion in August 2021.

The report stressed that it expects the reserves to stay low despite a “modest recovery” in 2023.

IMF Discussions

The report said that it assumes that Pakistan will be successful in the ninth review of Islamabad’s IMF bailout programme for a $1.2 billion tranche. It appreciated Pakistan’s “renewed commitment” to the talks, noting that the country appeared “close to agreement” with the IMF.

However, it highlighted that the IMF discussions are currently obstructed by issues such as Pakistan’s inability to collect sufficient revenue and withdrawal of energy subsidies. The discussions were scheduled to conclude in November 2022.

The IMF programme’s failure has caused reluctance amongst Pakistan’s traditional allies — China, Saudi Arabia, and the UAE — to provide fresh funding to Islamabad.

Fitch Ratings downgraded Pakistan's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'CCC-', from 'CCC+'.@GovtofPakistan @FinMinistryPak#Pakistan #Economy #AHL pic.twitter.com/MKnQXVbOTX

— Arif Habib Limited (@ArifHabibLtd) February 14, 2023

However, on the bright side, if Pakistan successfully secures $2.5 billion from the IMF, it will receive an additional $3.5 billion from other multilateral organisations, along with flood relief aid and other commitments.

Political Changes

The Fitch assessment further stressed that the IMF’s discussions and the overall economic situation in Pakistan are likely to worsen due to social and political issues.

It emphasised that the upcoming elections, scheduled to occur before October 2023, will likely see a political stand-off between former PM Imran Khan and current PM Shehbaz Sharif.

President to ECP: Immediately announce date of elections as Constitution doesn’t allow any delay.

— The President of Pakistan (@PresOfPakistan) February 8, 2023

The Letter 👇

https://t.co/o9PhBizBC5 pic.twitter.com/mTYkPVnduL

In addition, last year’s floods increased pressure on the government, which now has to mitigate post-disaster rehabilitation and infrastructural reconstruction.

While the report did not mention this, Pakistan is also struggling with increased terror activities across the country.