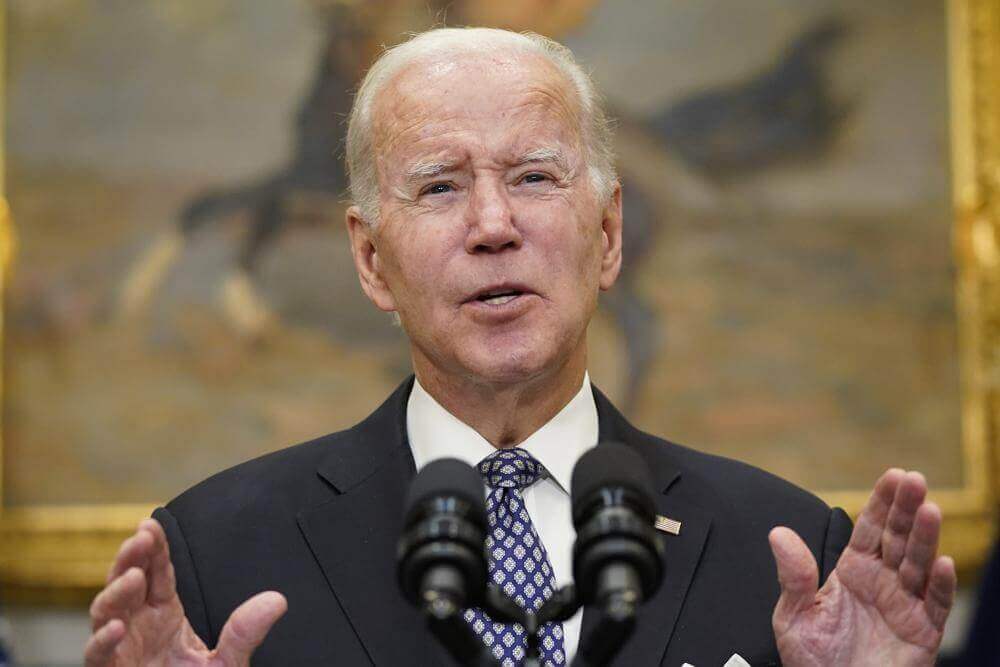

United States (US) President Joe Biden threatened to impose “windfall taxes” to stop the “war profiteering” energy companies from benefiting from the Russian invasion of Ukraine after they posted record-high profits.

“In the last six months, six of the largest oil companies have made more than $100 billion,” he stated during a press conference at the White House on Monday. He noted that these companies have “outrageous” profit margins, which if invested into the country, would bring down the gas prices by another 50 cents. Biden accused the companies of instead giving their excess profits “back to their shareholders and to buying back their stock.”

The oil industry has a choice.

— President Biden (@POTUS) October 31, 2022

Either invest in America by lowering prices for consumers at the pump and increasing production and refining capacity.

Or pay a higher tax on your excessive profits and face other restrictions.

“I think they have a responsibility to act in the interest of their consumers, their community, and their country; to invest in America by increasing production and refining capacity,” he asserted, adding that his administration would work with Congress to consider all available options.

Last week, the US’ largest oil companies – Exxon Mobil and Chevron – reported excess profits, which raised their dividends to “return excess cash” to shareholders. Exxon Mobil earned $20 billion in the third quarter, up 10% from the previous quarter. Chevron, meanwhile, recorded $11.2 billion in profit.

Gas prices are falling, but energy companies making record profits are still driving prices up by charging consumers far more than what they’re paying for oil.

— The White House (@WhiteHouse) October 30, 2022

Here’s what President Biden is doing to put that money back in your pocket. pic.twitter.com/zWxtei9Rft

Keeping this in mind, the International Energy Agency has said that the world’s oil and natural gas producers are set to double their income from 2021 to a historic high of $4 trillion. “Today’s high fossil fuel prices have generated an unprecedented windfall for producers,” it noted.

Nevertheless, both Exxon Mobil and Chevron are sticking to tight budgets, as Exxon Mobil’s chief executive, Darren Woods, pointed out that owing to its crucial refining business, they “plan for thin margins and tough conditions and hope for the best.” However, he acknowledged the “pain high prices cause” and promised to ensure that “people around the world and here in the US get affordable and reliable energy.” He also noted the challenges in the current climate, citing Europe’s slowing economy, continuing COVID-19 lockdowns in China, and uncertainty in the US.

In a similar vein, Chevron’s chief executive, Mike Wirth, highlighted the strong demand for diesel and aviation fuel but cautioned, “We’re going to stay very disciplined on capital and we won’t invest in everything that we could,” adding, “We continue to see a challenging and dynamic macroeconomic and geopolitical environment.”

“We’re not against companies making money…we just want them to invest,” U.S. special coordinator for energy Amos Hoschstein tells me as President Biden accuses Big Oil of war profiteering. pic.twitter.com/ykQdbBL09k

— Hadley Gamble (@_HadleyGamble) November 1, 2022

Likewise, US refiner Valero Energy Corp’s chief executive, Joe Gorder, said demand for gasoline and diesel is now at pre-pandemic levels, revealing that even jet fuel demand is “steadily approaching 2019 levels.” The company’s refined volume was 3 million bpd this quarter, 141,000 higher than last year. It also revealed that the refining profit margin had more than doubled to $5.90 billion this year.

PBF Inc’s gross refining margin, too, excluding special items, tripled to $2.26 billion in the last quarter, making its share prices rise by 8%. Its chief executive, Tom Nimbley, further revealed, “The underlying supply and demand fundamentals of the global hydrocarbon market created an environment that has allowed PBF to finish the third quarter with effectively zero net debt.”

FUN FACT: Domestic oil production is UP under President Biden — at the end of Trump's term it was 11 million barrels per day, and now it’s 12 million.

— Jon Cooper (@joncoopertweets) October 30, 2022

According to the US Department of Energy, US oil production is 4% higher than in 2021 at 11.7 million barrels per day (bpd) and is likely to increase to 12.3 million bpd next year. Moreover, in March, the Biden administration promised to release 180 million barrels from its Strategic Petroleum Reserves by December. Following a 15 million bpd release last month, reserves dropped to their lowest level since 1985 at 400 million barrels. Furthermore, Congress has agreed to sell 26 million barrels next year.

Meanwhile, European producer Shell is planning to buy back $4 billion worth of shares and increase its dividends by 15% after earning a record-high $9.45 billion, making its total profit so far this year $30 billion, 58% higher than the whole of 2021.

In June, Biden proposed a federal gas tax holiday.

— Javier Blas (@JavierBlas) October 31, 2022

Congress (controlled by his own party) didn't support it.

Biden is now about to propose a windfall tax on oil firms.

I expect the same (lack of) enthusiasm from Congress.#OOTT #EnergyCrisis

Keeping this in mind, the United Kingdom’s (UK) Labour Party climate change and net zero leader Ed Miliband has called for “a proper windfall tax to make the energy companies pay their fair share.” Shell CEO Ben Van Buerden has responded by saying the industry should confer with the government to ensure well-designed taxes. “We should prepare and accept that our industry will be looked at for raising taxes in order to fund transfers to those who need it most in these difficult times,” he has said.