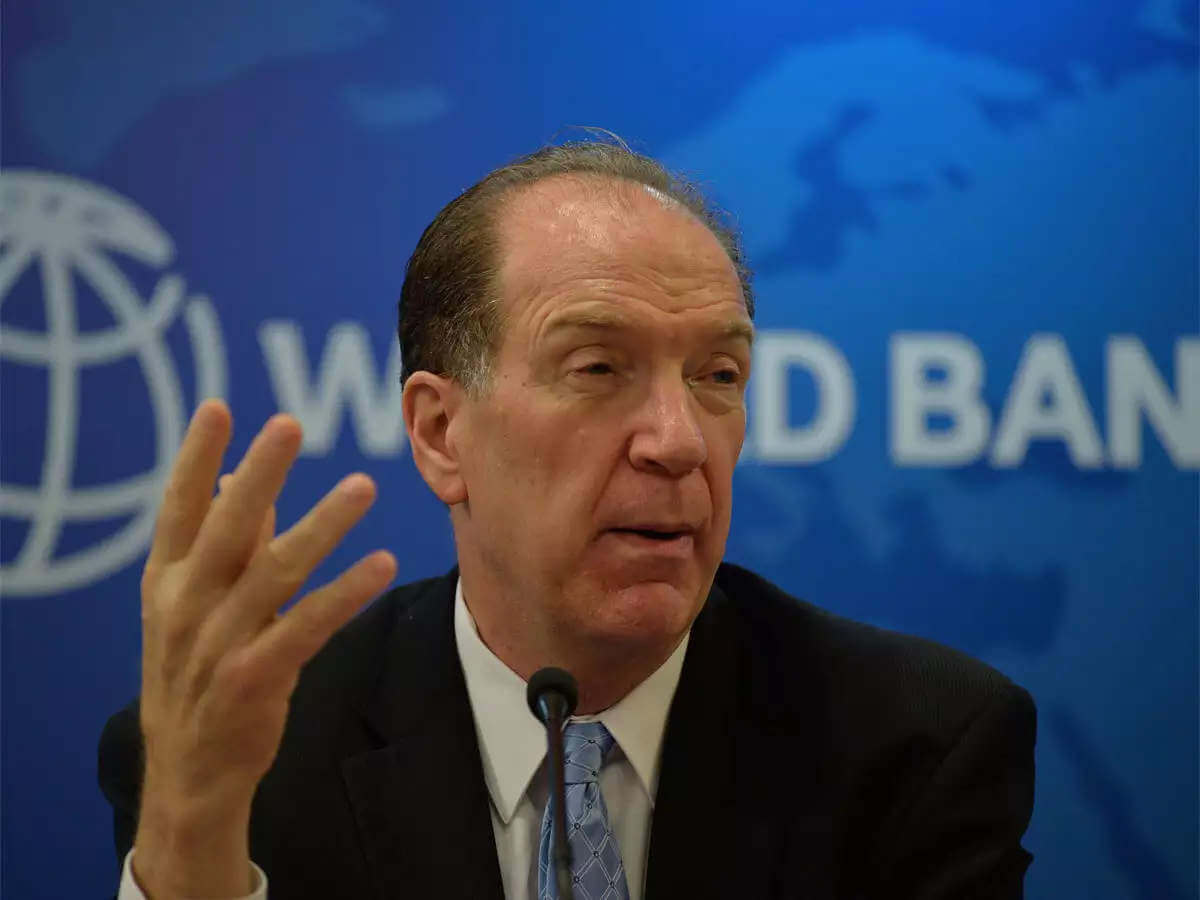

World Bank President David Malpass on Tuesday urged China to participate “fully” in debt relief efforts.

“Many countries are now facing record levels of external and domestic debt as interest rate hikes begin,” Malpass noted during a conference call. He added that about 60% of low-income countries are “at high risk” of debt distress while emerging economies “are struggling as well.”

“In 2022 alone [...] countries will have to pay around $35 billion in debt service to their official bilateral and private-sector creditors, with over 40 percent of that due to China,” Malpass said.

In this regard, Malpass asserted that “it’s crucial that China participates fully in international debt relief efforts,” adding that both the private sector as well as commercial creditors, must take part in the process.

The head of the Washington-based global development lender called for expediting the implementation of the “common framework” for debt restructuring. The “common framework” was agreed upon by the Group of 20 (G20) member nations, including China, in November 2020. It provides the provision of applying for debt relief or even cancellation for countries that need it.

Whole world should take lessons from what is happening in Sri Lanka.

— Abhishek (@AbhishBanerj) January 10, 2022

Unfortunately, SL signed up for China's economic plan

And now SL is on verge of bankruptcy

China has pushed them into a debt trap and destroyed their economy.

The framework succeeds the Debt Service Suspension Initiative (DSSI), which the G20 instituted in April 2020, at the beginning of the COVID-19 pandemic. The DSSI sought to give developing countries a moratorium on debt service payments due to the economic damage wrought by the coronavirus pandemic, until the end of 2020. The service was extended through last year.

Consequently, Chinese Vice Foreign Minister Ma Zhaoxu stressed Beijing’s commitment to the G-20 debt relief program and announced the suspension of debt repayments for 77 low-income and developing countries in June 2020. However, the country was reluctant to make a commitment or offer a plan to do the same.

Similarly, on several occasions, the Chinese Ministry of Foreign Affairs has referred to the ‘complexity’ of Africa’s debt situation, which has apparently made it difficult to offer debt relief or cancellation. The country merely said that it was “willing to study the possibility of it with the international community”.

This behaviour has brought China under increasing scrutiny over the last few years for practising what critics call ‘debt-trap diplomacy’, wherein its Belt and Road Initiative has arguably compromised the sovereignty of low-income countries, particularly in Africa.

China’s loans to Africa amount to roughly $160 billion, most of which has gone towards infrastructure projects. However, the money is loaned at high-interest rates, which forcefully increases and extends Africa’s dependence on China. For instance, Djibouti’s debt-to-GDP ratio rose from 50% to 85% after Chinese investment in 2014. In fact, it is estimated that around 20% of African government debt is owed to China; this figure rises to 44% in Zambia.

This heavily asymmetrical relationship and burgeoning disharmony in Africa-China ties have prompted actors like the United States and the European Union to step in, assuming the role of a benevolent alternative to China’s predatory lending practices.