Last week, Jordan and Saudi Arabia signed an agreement to connect the electric grids of the two countries via a 164 km line in a bid to free Amman from its dependence on foreign fuel suppliers by 2030. For Riyadh, the project is a crucial part of its larger plan to dominate renewable energy exports in the region.

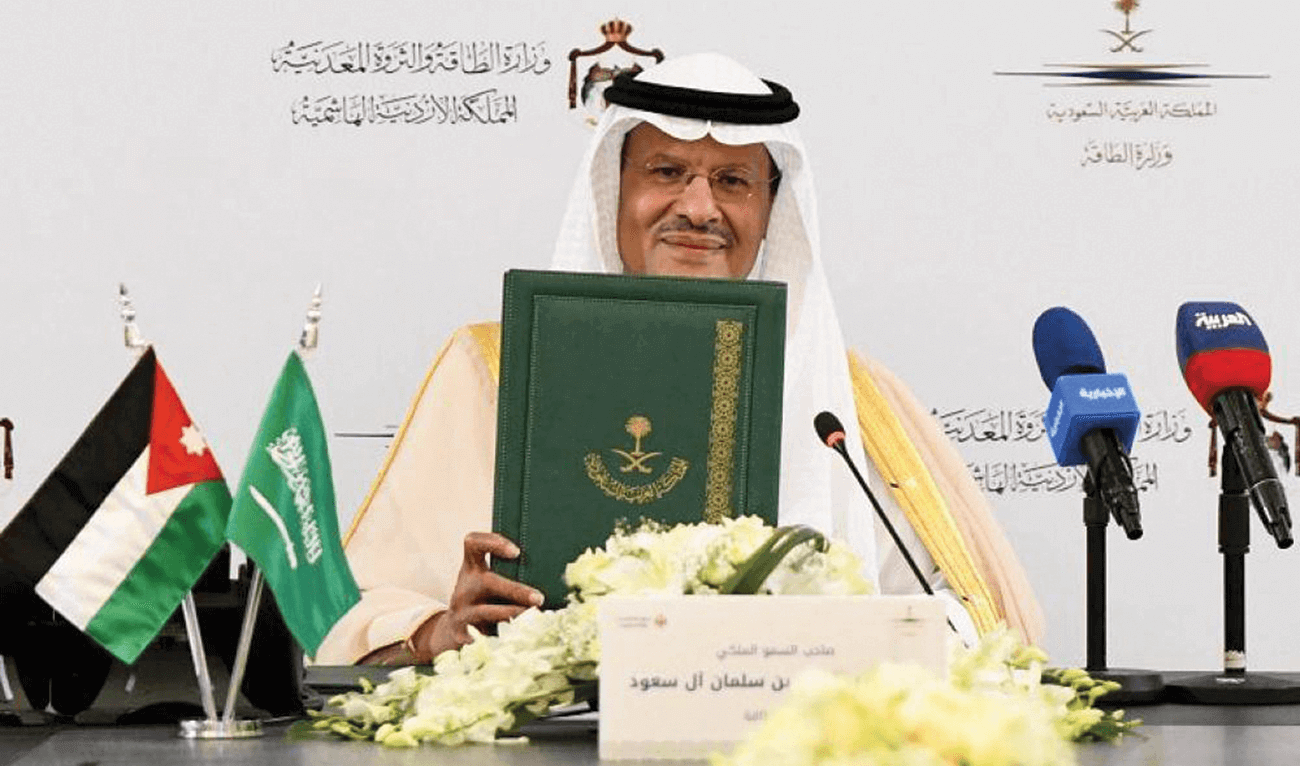

The memorandum of understanding (MoU) was signed by Jordan’s energy minister Hala Zawati and her Saudi counterpart Prince Abdulaziz bin Salman al-Saud. As part of its National Renewable Energy Program, Riyadh is set to build a new 200MW solar power plant near Qurayyat, which will be linked to East Amman via the signed agreement. Locating the deal within the Kingdom’s larger Vision 2030 plan, the Saudi prince said that “there are promising opportunities from the project to support the reliability of the electrical networks between the two countries, achieve economic savings, absorb renewable energy and achieve optimal investments in electricity generation projects”. Further, he insinuated that the two parties were looking to enhance their relations by establishing an optical fiber line between their communications networks in the future.

Zawati hailed the agreement as a crucial plan to stabilize electricity in both countries, as well as to boost the Jordanian energy sector over the next decade. A statement from the country’s energy ministry alluded that “the agreement would make Jordan a regional hub for energy exchange, especially as the Jordanian-Saudi power grid connection would be the starting point of the comprehensive Arab electricity interconnectivity”. While the cooperation agreement is assumed to be a longstanding one, no defined timeframe has been decided for the work yet.

Simultaneously, on 19 August, during Iraqi Prime Minister Mustafa al-Kadhimi’s visit to Washington, a $727 million deal was signed between Baghdad and several prominent American companies with the intention of reinforcing “Iraq’s transmission network interconnection with the electricity grid of Jordan”. Iraq has signalled that it would be looking to import around 200MW via a proposed Jordan link, since its 1.25GW imports from Iran are not adequate to provide a steady power supply to its people, often leading to mass protests. Under pressure from Washington to turn away from Tehran, Baghdad has also agreed to receive power from Turkey, its own semi-autonomous Kurdistan region, and the Gulf Cooperation Council’s Interconnection Authority (GCCIA), but the planned imports will take more than a year to reach fruition.

Similar to the Saudi deal, no details about the timeline or scale of the Iraq-Jordan interconnection were revealed, but Baghdad’s former minister for electricity Luay al-Khatteeb has confirmed that the previous government was preparing an import deal with Jordan. Further, he said that there were ongoing “negotiations with Saudi Arabia separately to import from the Jordan-Saudi Arabia-Iraq corridor for western Iraq.”

Previously, Jordan’s Nepco had signed a similar energy-based MoU with the GCCIA but has faced several hurdles in developing its own transmission grid that is capable of handling the onslaught of new renewable projects. While the Hashemite Kingdom has been troubled with increased oil import rates, soaring fuel prices, and gas shortages, its recent successes in securing long-term renewable and gas imports suggest that the country is working towards realizing its ambitions to turn into a regional electricity hub.

Jordan Expedites Electricity Hub Plans, Inks Grid-Sharing MoU With Saudi Arabia

However, no timeline has been decided for the work yet.

August 26, 2020

Saudi Minister of Energy Prince Abdulaziz bin Salman during the agreement-signing ceremony. SOURCE: SPA