On Tuesday, the Democrat-led House Ways and Means Committee accused the Internal Revenue Service (IRS) of failing to adequately audit former United States (US) President Donald Trump’s taxes while he was in office.

According to a 29-page report released by the panel, the IRS’ review of Trump’s taxes between 2017 and 2018 was “dormant, at best,” and only began on 3 April 2019 when Committee Chairman Richard Neal (D-MA) requested information related to Trump’s tax returns. However, it was not clear whether Trump had discouraged or influenced the IRS, which is legally required to audit presidents’ taxes, in any way.

Tonight’s decision comes after four years of this Committee’s work to review how the IRS enforces compliance with federal tax laws by a president.

— Rep. Linda Sánchez (@RepLindaSanchez) December 21, 2022

We found that under the prior admin, the program was dormant & failed to address the complexity of the president’s situation. 2/

“What people will likely be surprised about is the extent to which the IRS was not conforming to their own rules,” remarked Representative Dan Kildee (D-MI).

The document did not reveal any specific details on the amount of taxes that Trump paid on his millions of dollars in earnings while he was in office. In this regard, Representative Lloyd Doggett (D-TX) told CNN: “I think you’ll be surprised by how little there is,” adding that the returns showed there were “tens of millions of dollars in these returns that were claimed without adequate substantiation.”

Trump is a tax dodger. Either he pays $0 income taxes in most years or when he does pay it’s 2-5% of his income when folks in that income range pay 30% average (37% marginal).

— Nouriel Roubini (@Nouriel) December 21, 2022

Trump Paid $1.1 Million in Taxes During Presidency, but $0 in 2020, Report Shows https://t.co/ZUfCO7LbBR

The report also showed that Trump and his wife Melania Trump lost $31.7 million in 2015, $32.2 million in 2016 and $12.8 million in 2019 but reported $24.4 million and $4.4 million in income during these two years, before losing $4.7 million in 2020. It also showed fluctuations in the amount of taxes paid by the Trumps, with $2.1 million in 2018 being the highest and $271,973 in 2020 the lowest.

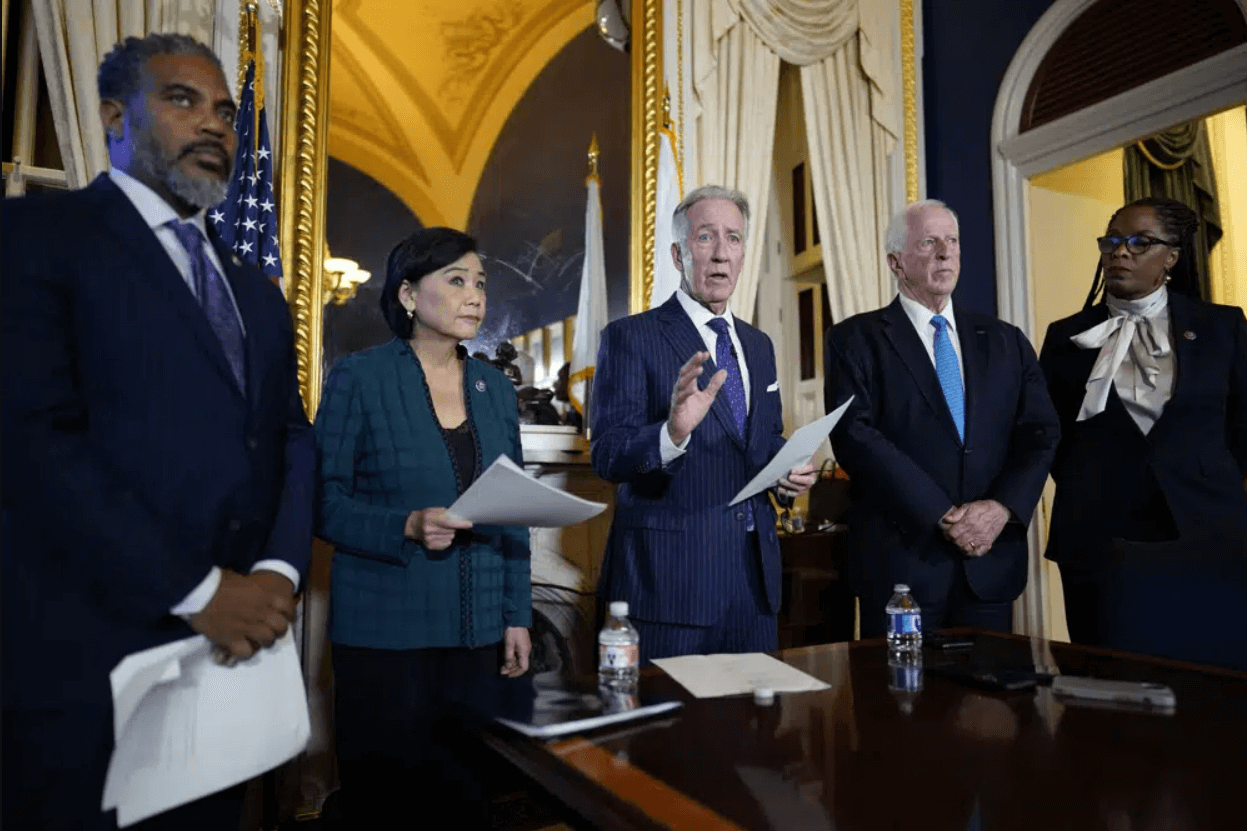

The report was published hours after the panel voted 24-16 to make Trump’s tax returns public within days. “This is about the presidency, not the president,” Neal told reporters, adding, “This was not about being punitive. This was not about being malicious. And there were no leaks from the committee. We adhered carefully to the law.”

It's clear that the IRS failed to adequately audit the former president.

— Rep. Steven Horsford (@RepHorsford) December 21, 2022

By releasing the tax returns, we are taking steps to rebuild the trust of the public as we conduct our oversight into these failures within the IRS.

🧵 3/3

In contrast, Republican Representative Kevin Brady (R-TX) opined, “Regrettably, the deed is done.”

“Over our objections in opposition, Democrats in the Ways and Means Committee have unleashed a dangerous new political weapon that overturns decades of privacy protections,” he asserted, adding, “The era of political targeting, and of Congress’s enemies list, is back and every American, every American taxpayer, who may get on the wrong side of the majority in Congress is now at risk.”

Trump is the first president in decades to refuse to release his tax returns, citing it as a violation of his privacy. It is not compulsory for a sitting president to do so. He has insisted that as long as the IRS continues to audit his tax returns, he won’t release them.

Years ago I called out trump treasury head mnuchin for breaking the law to his face. He lied on live TV. Tonight we learned I was right he broke the law to protect trump’s taxes. pic.twitter.com/cucQ2eZfWq

— Bill Pascrell, Jr. 🇺🇸🇺🇦 (@BillPascrell) December 21, 2022

Another 39-page report released by Congress’ Joint Committee on Taxation (JCT) on Tuesday found multiple mistakes with the IRS’ methods of auditing Trump and his companies. “We must express disagreement with the decision not to engage any specialists when facing returns with a high degree of complexity,” the report said, further asserting, “We also fail to understand why the fact that counsel and an accounting firm participated in tax preparation ensures the accuracy of the returns.”

According to a The New York Times report in 2020, Trump faced an IRS audit related to a $72.9 million tax refund resulting from a $700 million loss he claimed in 2009 before he became president. However, the two documents released on Tuesday showed that he continued to collect tax benefits from those losses until 2018.

“I’ve proposed legislation to put the program above reproach. Ensuring IRS conducts yearly, timely examinations while publicly disclosing certain information."

— Ways & Means Committee (@WaysMeansCmte) December 21, 2022

It also raised concerns about Trump’s tax filings, including his carryover losses, deductions tied to conservation and charitable donations, and loans given to his children, which could be considered taxable gifts.

The Democrats in the committee thus recommended that Congress strengthen the IRS and introduce a new bill “for the mandatory examination of the President with disclosure of certain audit information and related returns in a timely manner.” The bill would mandate reviews of presidential taxes within 90 days of their filing. House Speaker Nancy Pelosi (D-CA) noted that the chamber would “move swiftly” to take the legislation forward.

Neal added: “But I can say this that it is argued in the reports that one of the problems is that the IRS has the limited, if any, ability to hire the sort of specialists that they need to undertake an audit of a very sophisticated tax offering."

— Manu Raju (@mkraju) December 21, 2022

“Because of the dismantling of funding to the IRS, they have not been unable to do their job,” Representative Steven Horsford (D-NV) argued, adding, “They did not have the specialised staff to do it for that high-income category — not just this person, but people who fall into that category.”

However, the Republicans have vowed to cut funding for more IRS agents as soon as they take control of the House next month

Trump spokesperson Steven Cheung slammed the panel, saying, “This unprecedented leak by lameduck Democrats is proof they are playing a political game they are losing,” adding, “If this injustice can happen to President Trump, it can happen to all Americans without cause.”

Republicans now warning that releasing Trump’s tax returns could mean releasing Supreme Court justices’ tax returns.

— Tristan Snell (@TristanSnell) December 20, 2022

Exactly. For example, Americans deserve to know who paid off Brett Kavanaugh’s $92,000 country club balance, $200,000 in credit card debt, and $1,200,000 mortgage

The House Committee had requested Trump’s tax returns in 2019 as part of its assessment of whether the IRS was performing the annual presidential audits appropriately or whether it required new legislation. However, then-Department of Treasury Secretary Steven Mnuchin denied their request, calling it a “pretext” to go through Trump’s personal finances and a violation of personal taxpayer law.

Subsequently, Neal filed a lawsuit against Trump in July 2019, following which Federal District Court Judge Trevor McFadden, a Trump appointee, ruled in favour of the Committee in December 2021. The Department of Justice also agreed with the Committee in July 2021, saying it had “invoked sufficient reasons.”