According to The Independent, European Union (EU) shipping companies from Greece, Malta and Cyprus have doubled their oil cargoes and are transporting Russian oil “ship to ship” to other countries apart from the bloc, after Europe banned 75% of Russian oil imports in its latest sanctions package.

According to anti-corruption group Global Witness, ships owned by the three countries moved 31 million barrels of Russian oil in February, which rose to 58 million barrels in May. The three countries have thus transported 178 million barrels, worth $17.3 billion at current prices for Russian crude, since February.

This was made possible after intense lobbying from the shipping industry based out of the three countries so that they continue to earn massive profits by assisting in transporting oil from Russian ports to non-EU countries such as China and India.

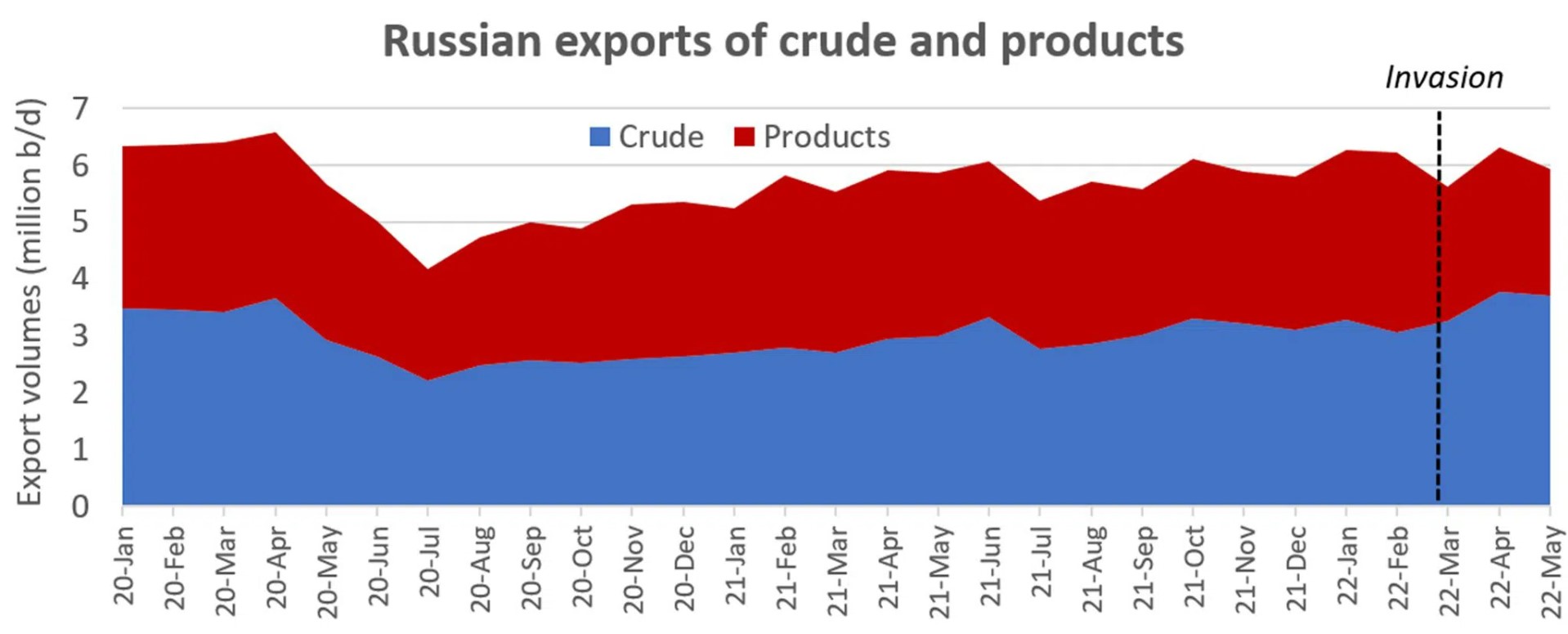

European companies have almost doubled their shipments of Russian oil since the start of Vladimir Putin’s invasion of Ukraine, despite desperate efforts by EU leaders to squeeze the Kremlin war machine by blocking Russia’s exports from global markets.https://t.co/pZumlfV29x

— The Sirius Report (@thesiriusreport) June 6, 2022

“Ships linked to Greece, Cyprus and Malta are making a mockery of the EU effort to sanction Putin’s war machine, keeping cash flowing to Russia as the country’s armed forces continue to pummel Ukraine,” says Louis Goddard, a senior data investigations adviser at Global Witness, adding, “To close this gaping loophole, the EU must stand firm against lobbying from all member states with vested interests in the Russian oil trade, and put restrictions on shipping at the heart of its sanctions regime.”

China has become the largest importer of Russian oil in the world since the Ukraine war began, while India has nearly quadrupled its purchase of Russian oil due to heavy discounts. India is now receiving about 600,000 barrels a day from Russia, up from 90,000 a day last year.

Many major companies like Frontline, International Seaways, Shell, and BP have stopped exporting Russian oil in accordance with the United States (US) and EU sanctions. However, minor companies, which have continued to partake in the Russian oil business, have managed to make enormous profits. A large tanker departing from Primorsk could collect $32,500 a day now, compared to less than $10,000 before the invasion.

In this regard, an investigation by Lloyd’s List found that most of the Russian oil is now being moved aboard ships of private Greek owners—Aframax (750,000-barrel-capacity) and Suezmax (1 million-barrel-capacity). With the United States (US) not targeting the transport of Russian petroleum, unlike with Iranian and Venezuelan tanker exports, Aframaxes and Suezmax are thus profiting from Russia’s invasion, despite refraining from using Russian shipments.

There have been increasing concerns about whether the Greek shipping industry, which owns 26% of the world’s tankers, will be facing any repercussions for moving Russian oil. In this respect, Greek Prime Minister (PM) Kyriakos Mitsotakis asserted, “Less oil will be transported from Russia to Europe. However, I would like to highlight that there are no sanctions that prohibit Greek shipping (companies) from transporting Russian oil to third countries.”

Similarly, Greece’s former finance minister, Yanis Varoufakis, revealed that though the Greek ship owners have a vested interest in the war, he said that the industry contributes “next to nothing” to the Greek economy because its vessels are often registered in other countries and its profits are kept offshore.

The EU has decided to phase in the restrictions on insurance of Russian oil shipments from one month to three months following extensive negotiations with member states. Experts believe that this would further undermine the effectiveness of the bloc’s sanctions against Russia, as 45% of the country’s revenue comes from its oil and gas imports.

David Goldwyn, a top State Department energy official in the Obama administration, opined that restricting insurance of vessels should be a “necessary first step,” adding, “Why wait six months? As the sanctions are configured now, all that will happen is you will see more Russian crude and product flow to other destinations.”

Echoing this argument, Lars Barstad, the chief executive officer of Frontline, which owns the largest fleet of tankers, said that his ships don’t carry oil if they are not insured against environmental damage. “If in effect, it would be a very strong hindrance to export Russian crude,” he noted.

Russia has registered a record current-account surplus in April due to the oil price hike, and the government is on track to track to receive an unprecedented $250 billion this year, as per Clay Lowery, the vice-president of the Institute of International Finance.