A report by European financial services company Allianz suggests that China will begin to “slow its international engagement over the next few years”, particularly in Africa, due to the coronavirus-induced slowdown in economic growth and its rising domestic debt burden.

Allianz says that the current global economic recovery is unlike the 2008 financial crisis, as China currently faces two unprecedented challenges: “declining potential growth and a deteriorating external environment”. The German company forecasts that Beijing’s GDP growth is likely to hover between 3.8% and 4.9% over the next decade, after averaging 7.6% during the 2010s. The researchers posit that, on account of “declining labor supply and slowing productivity and capital investment” and “looser economic ties” with Washington, China is likely to look more inwards to facilitate its continued growth.

In fact, China was already cognizant of the changing economic landscape both at home and across the globe as early as May, when President Xi Jinping first began to reformulate the country’s 14th five-year plan, which was ultimately unveiled in October. Described as a “dual circulation” strategy, China is set to prioritize “increasing domestic demand and lowering dependence on foreign inputs”, while still “maintaining export market shares and liberalizing capital flows”.

At the same time, China is not yet at the stage of its industrial development where it can completely unseat American, Japanese, German goods from the market. While China has been increasing its investment in “emerging economies” such as Indonesia, India, Thailand, Mexico, and Chile, and also expanding its Belt and Road Initiative (BRI), particularly in Africa, Allianz predicts that Beijing’s “role as a global growth driver” will “recede in the coming years”.

China essentially finances the debt of low and middle-income countries like Ethiopia, Kenya, Zambia, to help them “bridge their infrastructure gaps” and also offers large commercial loans to countries with “high default or sovereign risks” like Argentina, Ecuador, and Angola. This in turn projected China as an emerging and benevolent superpower that could carve out competing spheres of influence to challenge US hegemony. At the same time, it also paved the way for Chinese firms to gain control of crucial natural resources and oil fields in several countries.

For instance, there are now over 22,000 Chinese nationals living in Zambia, in charge of 280 companies. Chinese companies have seized control of Zambia’s copper industry, which accounts for 70% of the country’s export revenues. Moreover, their control has expanded beyond the copper industry, with Chinese state-owned firms winning contracts to construct airports, highways, hydro-electric stations, sports stadiums, and several other infrastructural projects.

However, with the onset of the coronavirus pandemic, it became increasingly clear that several of these countries are not going to be able to repay these loans, at least in the short to medium-term. All in all, this is expected to result in China being more cautious in giving out loans, but also decrease its iron ore and oil and gas consumption.

This unforeseen and seismic overhaul to its strategy is particularly significant, as China’s trade with Africa rose by 19.7% just two years ago. Having loaned upwards of $160 billion to African countries, it is estimated that around 20% of African government debt is owed to China. Most of this has gone towards infrastructure projects; however, the money has been loaned at high-interest rates, which forcefully increases and extends Africa’s dependence on China, in a practice that has been labeled as ‘debt trap diplomacy’.

China, for its part, has offered some debt relief to these countries. Beijing has previously canceled $160 million in debt owed by Sudan in 2017, and $78 million owed by Cameroon, $7.2 million owed by Botswana, and $10.6 million owed by Congo-Brazzaville in 2018.

Furthermore, in June, Chinese Vice Foreign Minister Ma Zhaoxu announced the suspension of debt repayments for 77 low-income and developing countries, signaling China’s commitment to the G-20 debt relief program that was agreed to on April 15. This process was formalized in October, when the G20 announced a suspension on debt payments for a further six months in a bid to relieve the economic burden placed by the ongoing coronavirus pandemic on the poorest nations.

The latest report by Allianz suggests that China now views the debt-fuelled rewards of increasing its foreign influence and access to crucial resources as unsustainable in the long run. Given the escalating nature of its ‘Cold War’ with the United States, however, it is at present difficult to envision a scenario in which China would walk away from such engagements, particularly at a time when it is coming ever-closer to challenging US hegemony.

Allianz Report Predicts China Will “Slow” Its International Engagements in Coming Years

The European financial services company predicts that Beijing’s “role as a global growth driver” will “recede in the coming years” due to the economic impact of the current pandemic.

November 25, 2020

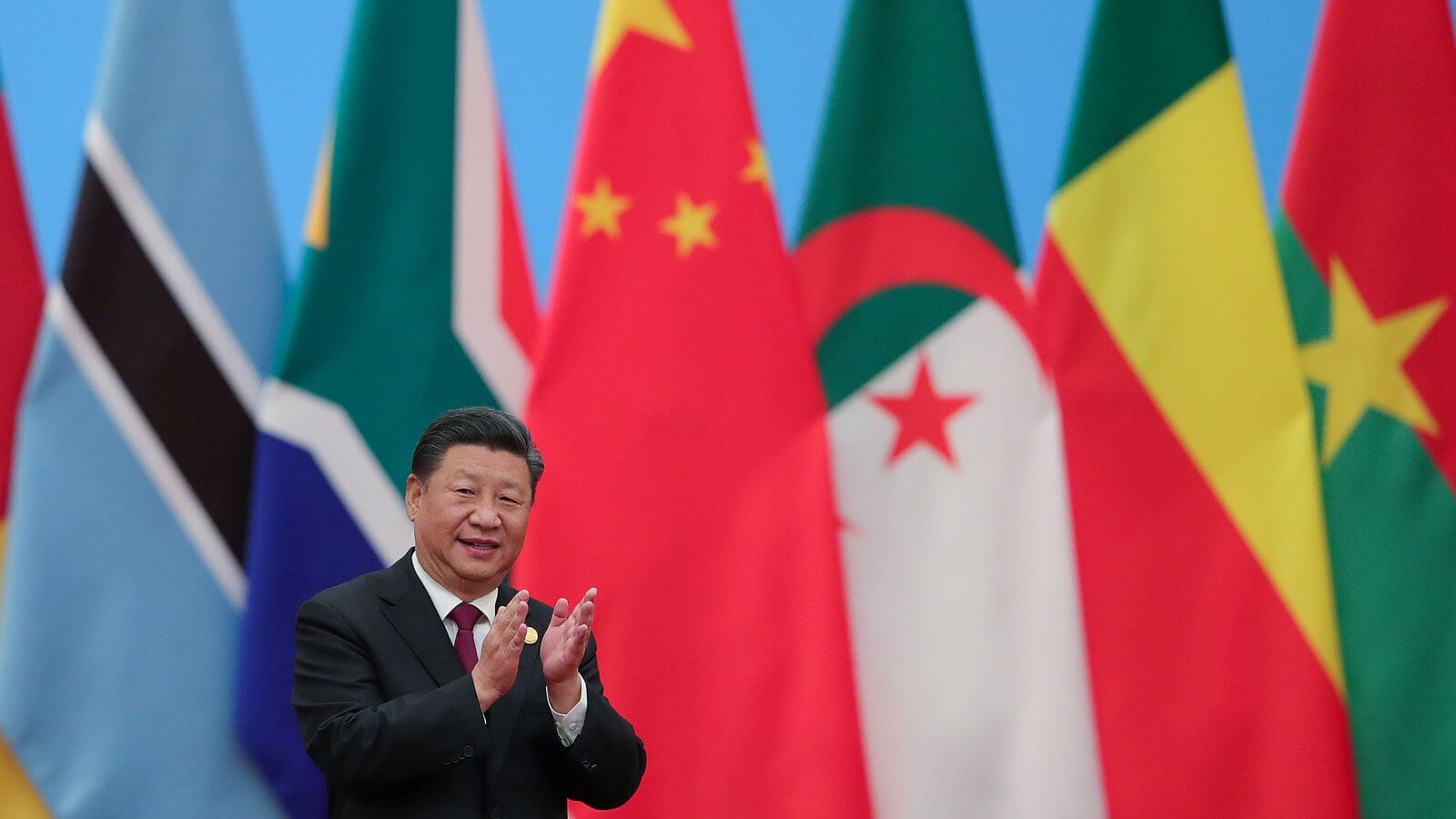

IMAGE SOURCE: LINTAO ZHANG / REUTERSChinese President Xi Jinping